During the mid-1980s, concerns were raised regarding the prevalence of Moneylenders in Ireland. In particular, it was reported that low-income families, including people living on social welfare income, were more likely to use such high-cost credit.

The Combat Poverty Agency research staff carried out a study focused on Moneylending and Low-Income Families. The study was undertaken in response to a request from the Minister for Social Welfare, Dr Michael Woods, following considerable publicity about moneylending.

Several recommendations were set out in the report, such as:

To address some of these recommendations, the report stated that a limited Money Advice Service should be set up on a pilot basis, targeting specific low-income groups.

The service would have 3 functions initially. The 3 functions would be to:

An additional recommendation in the report was to address access to credit and bill payment schemes on a national basis. Such schemes had been in operation in the Lough Credit Union, Cork and 3 credit unions in Waterford. These schemes proved incredibly positive in supporting low-income families to reduce their dependency on moneylenders by offering guaranteed loans in Credit Unions with the support of the Society of Saint Vincent de Paul.

In April 1990, the Loan Guarantee Fund (LGF) was established nationally. This was a revolving fund of £200,000 (€253,947) administered by the Society of Saint Vincent de Paul. Funding for the LGF was provided equally by the Department of Social Welfare and the Banks’ Standing Committee.

In addition to the access to credit, additional provisions were made to social welfare legislation in 1991 that allowed for deductions from social welfare payments. With the claimant’s consent, payments could be made to utility providers such as gas and electricity and to rent payments.

The scheme was to help address arrears management and collection costs and was officially launched in 1993

This service continues today, called Household Budget, and is operated in partnership with An Post.

The second initiative to address problems of moneylending and indebtedness was announced. In February 1992, the Government of the day allocated £260,000 (€330,132) to set up 5 pilot projects to ‘combat moneylending’. These pilots were the first 5 offices of the national service now known as MABS, the Money Advice and Budget Service. Minister Charlie Mc Creevey officially launched MABS on September 22nd, 1992.

Read the full press release (pdf) from Charlie McCreevy TD, Minister for the Department of Welfare.

The 5 pilots were in Cork City, West Clare, Limerick, Waterford, and West Dublin. These locations are still in operation today.

The Cork city Project officially opened on the day of the announcement, and Brendan Roche, who was seconded from his post in the Lough Credit Union, was the first service coordinator.

Brendan had been active in combating problems of moneylending for many years and pioneered the ‘Lough’ method of bill payment and budgeting facilities for members on low incomes. This method was known as the Special Accounts Scheme.

Official opening of Cork City MABS

Gerry Fitzpatrick, Kathleen O’Driscoll, Minister Michael Woods, Sheila Doyle, Liam Edwards, Brendan Roche (RIP)

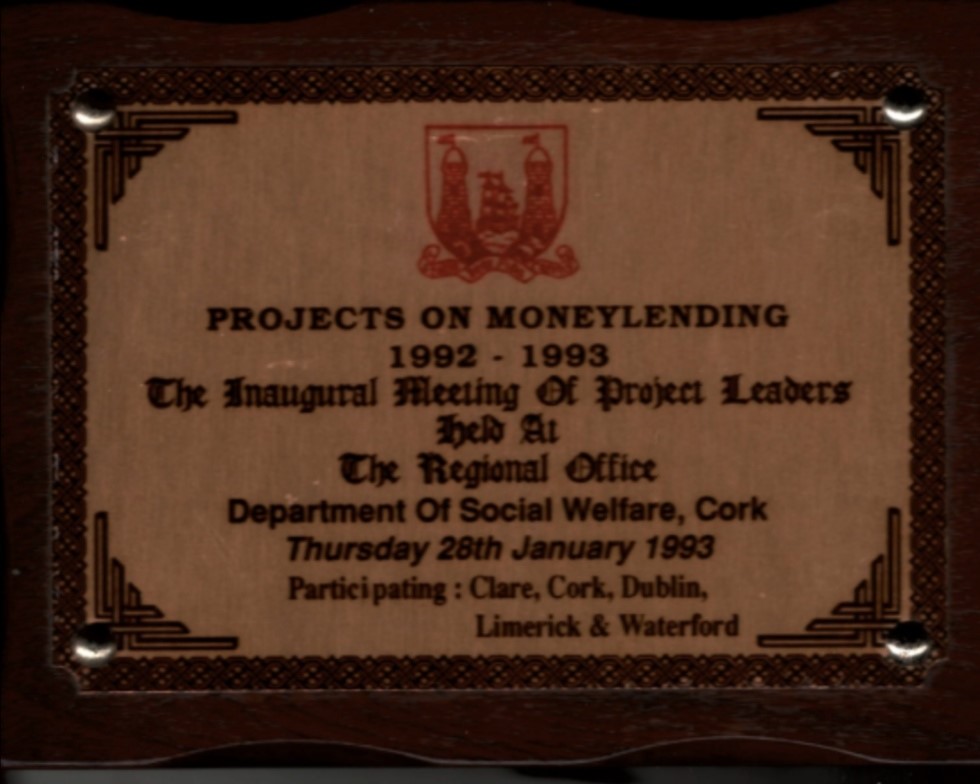

Wall plaque incorporating the new project locations

In 1993, an evaluation of the pilot projects was completed by NEXUS Research Cooperatives. The report recommendations included extending access to the services nationally.

The evaluation found that the 5 services were running with different approaches and recommended a uniform approach to services offered and project management. In 1994, Liam Edwards was announced as the national coordinator of MABS (pdf).

The service continued to grow across the country, and there is now at least 1 MABS office in every county in Ireland.

The special account facility became operational through MABS offices across the country.

The facility was a creditor payment system organised and supervised by MABS in conjunction with the credit unions. It enabled clients to save weekly in a Special Budget Account for payment of bills. In cooperation with the money adviser, clients prioritise creditors. For many clients, particularly those without access to banking facilities, the Special Account Scheme played a vital role in helping them regain control of their financial situation.

It should be noted this facility is no longer available due to regulatory changes over recent years. The facility ceased to take on new clients at the end of 2021.

For 30 years, MABS has remained agile in the face of change. The service has expanded to offer a limited personal insolvency service in recent years. Working with stakeholders and partners in the industry, MABS is recognised by the State as the gateway to the Abhaile free mortgage arrears scheme. In more recent times, MABS has worked with utility providers to develop and provide access to hardship funds. These funds are necessary due partly to COVID-19 and the increases in the cost of living because of increased inflation.

Today, MABS provide a wide range of money, debt, insolvency, budgeting, and advocacy services in over 50 locations nationwide, through the national helpline, WhatsApp service, and online at mabs.ie.

Trained staff provide advice on managing money and help people deal with a wide range of debts. Common types of client queries include, but are not limited to:

Support is available to everyone, regardless of their financial circumstances. MABS prides itself on providing a free, confidential, and independent service, all without judgement.

We’re in the process of building this page and will add more newspaper snippets, photos, and general information about MABS over the coming weeks and months.

Don’t miss out! Follow @MABSinfo on Facebook, Instagram, and Twitter (all links open in a new window) to stay up to date with the latest news and announcements as MABS celebrates this important milestone of 30 years of serving the community of Ireland.

| Office | Date |

| Ballyfermot | Sep-92 |

| Limerick | Sep-92 |

| Clare | Sep-92 |

| Waterford | Sep-92 |

| Cork | Sep-92 |

| Lombard St | Feb-93 |

| Clondalkin | Apr-93 |

| Carlow | Jul-93 |

| Ballymun | Mar-94 |

| Offaly | Jul-94 |

| Dundalk | Aug-94 |

| Drogheda | Sep-94 |

| Mullingar | Sep-94 |

| Kilkenny | Feb-95 |

| Tallaght | Mar-95 |

| Finglas | Apr-95 |

| South Galway | Apr-95 |

| Monaghan | May-95 |

| Tipperary | May-95 |

| Bray | Jun-95 |

| North Galway | Jun-95 |

| Laois | Aug-95 |

| Kilcock | Aug-95 (Sub-office) |

| Blanchardstown | Sep-95 |

| Thurles | Sep-95 |

| Mallow | Oct-95 |

| Cavan | Dec-95 |

| Charleville | Jan-96 |

| Francis St. (Dublin) | Feb-96 |

| Kerry | Mar-96 |

| Swords | May-96 |

| Sligo | May-96 |

| Wexford | May-96 |

| North Mayo | Jun-96 |

| Navan | Aug-96 |

| Athlone | Sep-96 |

| Crumlin | Sep-96 |

| Dun Laoghaire | Jan-97 |

| Newbridge | Jan-97 |

| Longford | Feb-97 |

| Clonmel | Apr-97 |

| North City | Sep-97 |

| Roscommon | Nov-97 |

| Nenagh | Nov-97 |

| North Donegal | May-98 |

| Dundrum | Sep-98 |

| Coolock | Jan-99 |

| South Mayo | Feb-00 |

| Arklow | Feb-00 |

| Leitrim | Jul-00 |

| Donegal Town | Nov-02 |

| West Donegal | Nov-02 |

| Buncrana | Jul-05 |

Facebook

twitter

Instagram