How MABS Helps You Manage Your Money

The rising cost of living is a cause for concern for all, no matter your income. MABS can help you manage your money and stay on track financially or help you tackle debt, if managing money has become a problem.

How We Help

The MABS money advice process is based on creating a realistic and sustainable budget. This can be for an individual or family in order to help them manage their money. Learning how to budget is a life skill, and MABS will support you to create your own budget unique to your lifestyle and financial commitments.

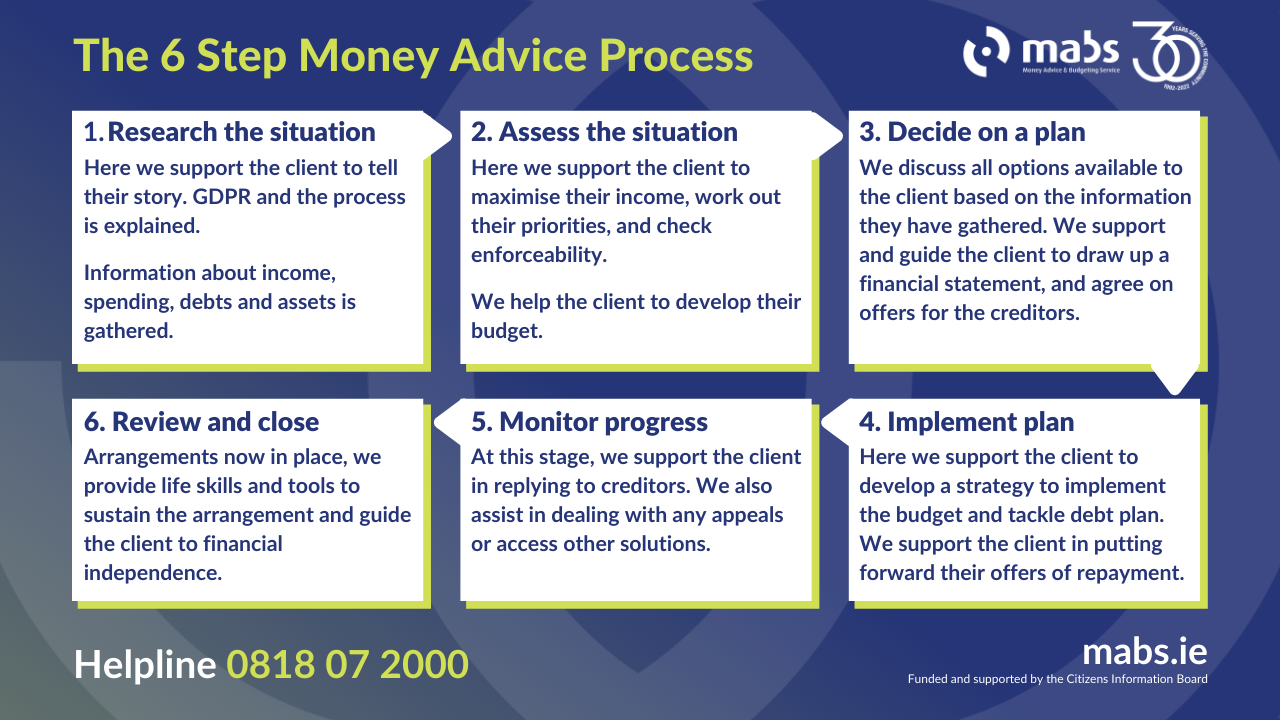

What’s the process?

During this process, we support you to review your spending and identify areas where you could achieve savings by, for example, shopping around for insurance premiums or utilities. Or by reviewing automatic direct debits such as subscriptions to streaming services that you may have forgotten.

Similarly, we explore ways how you can increase your income and ensure you are accessing all your entitlements.

MABS will review and discuss various payment options available to help you manage your money. For example, buying a tv licence through savings stamps or using the Billpay service in your local post office.

MABS also recognises the importance of building savings into your budget to plan for special occasions such as Christmas, family weddings, and college. A savings account in your local Credit Union can help with planning for the future.

Why come to MABS?

Many people come to MABS because they have problem debt or are at risk of getting into debt. MABS will support you to develop a realistic repayment plan to address your debts. While ensuring you have enough funds to cover your day-to-day living expenses.

If you are having difficulties managing your money, contact the MABS Helpline for advice or visit mabs.ie. We have a variety of money tools available to help you manage your money and stay on track or get back on track with your finances.

Next Steps

Budgeting and looking closely at your spending habits can be tricky. But once you take a step back and review your finances, it may be easier than you think! Read our latest blog to discover our top Tips on Tackling the Cost of Living (Part Two). Did you miss Part One? Check it out here.

If you have any other questions or would like to speak to a member of MABS, call our National Helpline on 0818 07 2000 Monday to Friday, from 9am to 8pm, WhatsApp 086 035 3141 or request a callback if you want to talk confidentially about budgeting, problem debt or general financial matters.

Facebook

twitter

Instagram