MABS Approach to Budgeting

Budgeting. It’s probably going to be word of the year. With ongoing increases across every area of spending – electricity, food and fuel just to name a few – everyone is becoming more aware of their household expenses and how to budget better.

In this blog, we’ll discuss how we at MABS approach budgeting and work with you to create a realistic and sustainable budget for you and your individual situation.

Getting Started

What is a budget?

A budget is a plan that sets out your income (the money you have coming in) and expenses (the money you have going out), so you can control your finances better.

Some people budget weekly, monthly, quarterly, or even yearly, depending on their needs. To start, we will focus on a budget based on your pay packet to keep things simple, and you can build from there. With current price increases, starting with your pay packet makes sense as you may need to adjust every few months to account for increases that you cannot predict due to inflation.

Learning how to budget is a life skill, and MABS will support you in creating your own budget unique to your lifestyle and financial commitments.

We have two blogs – A Beginners Guide to Budgeting – Why We Budget and A Beginners Guide to Budgeting – How to Get Started if you’re eager to get going!

What’s the MABS Budgeting process?

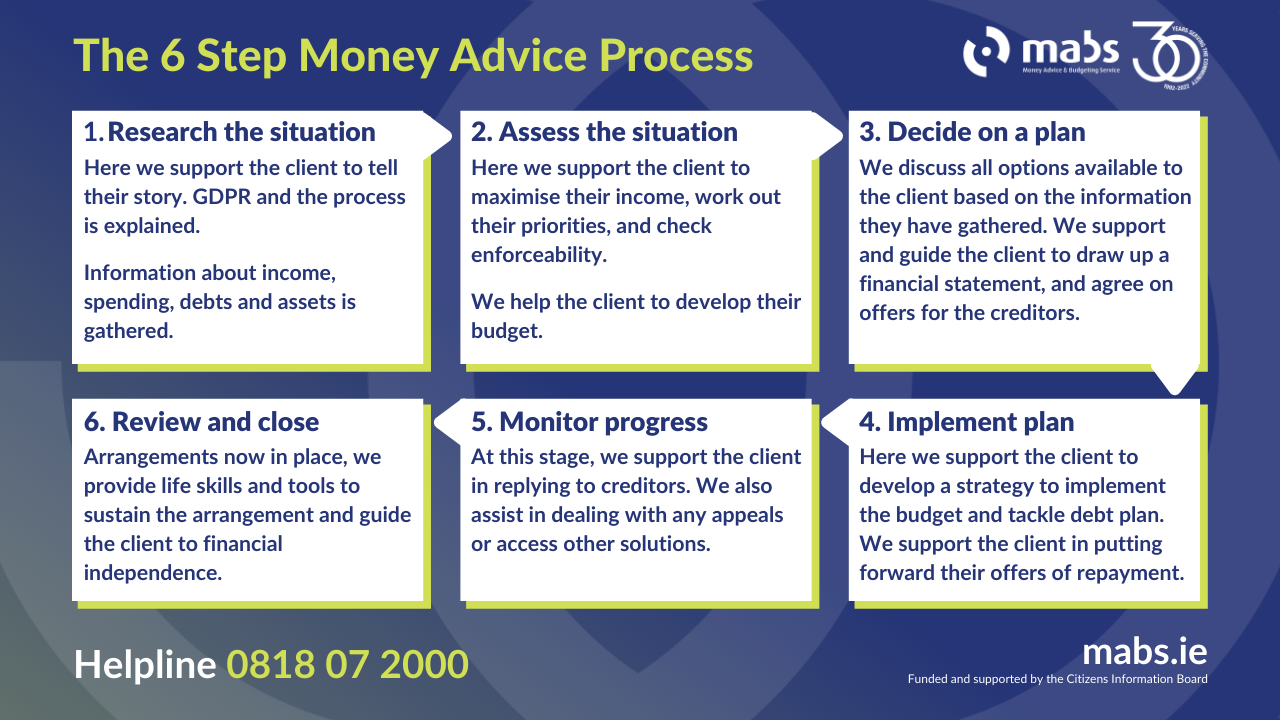

When you come to MABS, we have the Money Advice 6-Step approach outlined below.

We start by reviewing your spending and identify areas where you could achieve savings by, for example, shopping around for insurance premiums or utilities. Or by reviewing automatic direct debits such as subscriptions to streaming services that you may no longer use or need.

Similarly, we explore ways how you can increase your income and ensure you are accessing all your entitlements.

MABS will review and discuss various payment options available to help you manage your money. For example, buying a TV licence through savings stamps or using the Billpay service in your local post office.

Check out the 6-Step Money Advice journey you’ll be guided through when you work with a MABS adviser.

Why come to MABS?

Many people come to MABS because they have problem debt or are at risk of getting into debt. However, you can come to MABS with any money concerns you have. MABS will support you in developing a realistic repayment plan to address your debts. While ensuring you have enough funds to cover your day-to-day living expenses.

If you are having difficulties managing your money, contact the MABS Helpline for advice. We have a variety of money tools available to help you manage your money and stay on track or get back on track with your finances.

If you have any questions or would like to speak to a member of MABS, call our National Helpline on 0818 07 2000 Monday to Friday, from 9am to 8pm, WhatsApp 086 035 3141 or request a callback if you want to talk confidentially about budgeting, problem debt or general financial matters.

Facebook

twitter

Instagram