What are Reasonable Living Expenses (RLEs)?

Do you get confused when you see a letter with lots of acronyms and have no idea what they mean? You’ve most likely seen the headlines about mortgage sustainability and affordability but don’t quite know where the numbers come from. We’re here to help break down the myths and common terms you may come across. This time, we’re talking about Reasonable Living Expenses or their acronym – RLEs.

What are Reasonable Living Expenses?

Reasonable Living Expenses (RLEs) serve as guidelines. Their purpose is to help ensure that a borrower, who is in mortgage arrears, can maintain a reasonable standard of living. Simultaneously, these guidelines provide valuable assistance to the borrower in their journey towards resolving their debt problems.

RLEs cover the borrower’s day-to-day expenses, which are necessary to have a reasonable standard of living. The Insolvency Service of Ireland (ISI) monitors and updates the RLE guidelines annually (required by the Personal Insolvency Act 2012). The ISI considers that, for the purposes of the Act, “a reasonable standard of living is one which meets a person’s physical, psychological and social needs.”

These guidelines cover expenses such as food, clothing, health, household goods and services, communications, socialising, education, transport, household energy, childcare, insurance and allowances for savings and contingencies.

Why are Reasonable Living Expenses used?

RLEs are designed to help protect borrowers by ensuring they have enough money each month to cover expenses without overstretching themselves. This commitment to having essential expenses covered can greatly impact the borrower’s physical and mental well-being. RLEs can help a Personal Insolvency Practitioner (PIP) determine the best possible arrangement for a borrower in home mortgage arrears.

The PIP knows how much spare income the borrower has left over at the end of each month to repay their creditors. This benefits the borrower as they are paying into an arrangement at a rate that matches their means. Borrowers in mortgage arrears can access the services of a PIP for free through the Abhaile scheme through a voucher.

You can find the list of Abhaile PIPs

How are Reasonable Living Expenses determined?

- Household Composition– number of adults and children (if any) living in the house.

- The need for a motor vehicle requires assessing whether public transport in the area is sufficient. Costs will be reflective of which option the household requires.

- Consider what reasonable and sustainable accommodation is for the household composition regarding housing costs. What are the costs for alternative accommodation, if available?

- Using childcare constitutes a significant expense.

- Regarding Motor Vehicle and Home Insurance – Given the varying nature of motor vehicle requirements and insurance, coupled with the impact of inflation in the building industry on home insurance, we made a strategic decision in 2021. Consequently, we moved these from set costs to their own standalone category.

- Special circumstances – we need to reflect any specific household or individual requirements on a case-by-case basis – e.g. disability.

What are considered Reasonable Living Expenses?

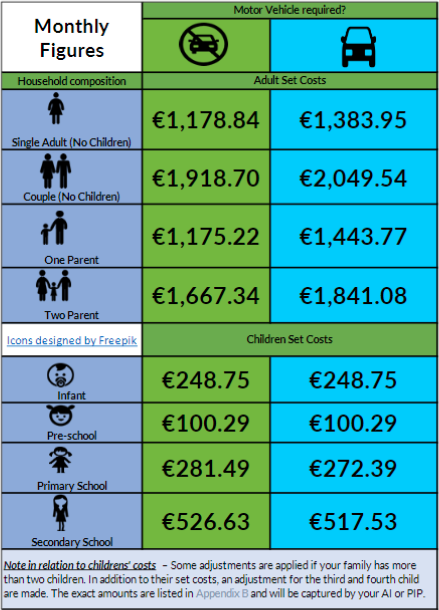

The table below is taken from the ISI and displays the monthly set costs considered to be Reasonable Living Expenses. Note about children’s costs – some additions are applied if your family has more than two children.

You can read the RLE guidelines in full at this link – Guidelines on a reasonable standard of living and reasonable living expenses. Published by the Insolvency Service of Ireland (ISI).

It is important to note these are guidelines. A borrower is not required to spend their money as listed in the breakdowns; they have total control over their spending.

How do I work out my RLE?

The ISI has a helpful online RLE calculator to help you work out what your household’s reasonable living expenses are.

If you would like more information on RLEs and the mortgage arrears supports available through Abhaile, call the MABS Helpline on 0818 07 2000 to speak with a Dedicated Adviser.

Disclaimer: This blog does not represent legal advice and is intended for guidance only. However, if you are concerned about your current or future personal financial situation, then please contact an adviser from MABS. Advisers are available by phone, email and in-person in locations nationwide.

Note: We welcome references to and use of the content in this blog. However, please reference MABS, and link said content if you choose to do so.

Originally posted: July 2020.

Updated: 15 January 2024.

Facebook

twitter

Instagram