When it comes to keeping our money safe, there are many dangers you need to be aware of. These ‘dangers’ can be harmful to your money, such as, scams or they can be a simple unawareness of what you’re entering into or doing with your money when its come to Buy Now Pay Later (BNPL), for example.

Either way, it is important to know all the facts. Money is hard earned but easily lost. We must protect it as best we can and that is where MABS is here to help.

BNPL has become increasingly popular in recent months. Whether you may not have heard of it or it sounds familiar, we are going to provide our top tips on what to look out for when it comes to BNPL, as well, as discussing online scams.

Buy Now Pay Later, what do I need to know?

So, what exactly is BNPL and why do we need to be aware of it?

Buy Now Pay Later is something we’ll come across when shopping – either online or in a store.

By definition, it is a type of short-term financing that allows consumers to make purchases and pay for them over time, usually with no interest.

Online sites, such as Klarna, are offering BNPL on clothes and gaming and this can be very tempting.

Some celebrities, bloggers or social media influencers may endorse a must have product that we feel we need right now. As a consumer and spender, we need to be fully aware of Buy Now Pay later before we spend our money.

Many businesses give the option to consumers to spread out the payments of a purchase, rather than paying in full at the checkout. This can be very tempting, however, it is a form of credit so we need to inform ourselves!

Before entering into a BNPL agreement, it is important to ask:

- Do I really need this purchase?

- Could I buy the item outright?

- Could I potentially use some of my savings?

- Can I afford the repayments?

- If I miss any repayments, will I be charged?

What online scams should I be aware of?

Unfortunately, there are many dangers and scams with unscrupulous people trying to get at our money. We need to be smart when it comes to keeping our money safe.

Have you come across any scams, especially online or on your mobile phones?

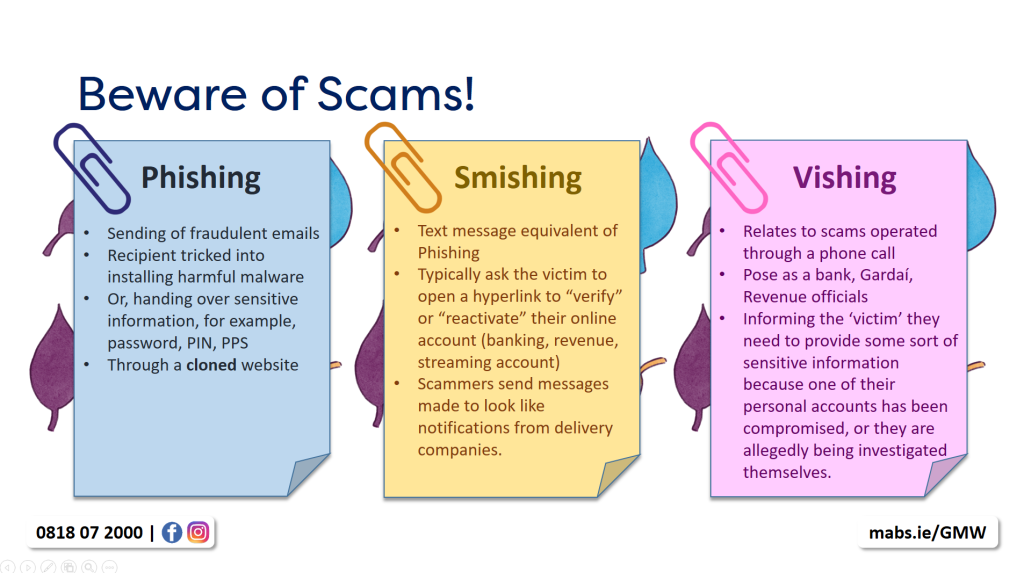

We are going to discuss three forms of scamming, known as:

- Phishing

- Smishing

- Vishing

As we said before, the money we have is limited, so it is important to be careful when sharing our financial information – especially online.

Also, be suspicious of ‘too good to be true offers’, selling goods and services cheaper online. Avoid clicking on offer sites on social media too!

Want to learn more?

Keep reading to learn about saving and spending. Or, maybe you’d prefer to get to the MABS Global Money Week homepage.

You can also visit the Global Money Week Official Website for more information.

Facebook

twitter

Instagram