Simply, a budget is a plan for managing your money and helps you plan for the future.

A well-planned budget is important for you, it will help you to organise the money coming in (your income) and the money going out (your expenditure). The important thing about a budget is that it will help you to plan for bills, unexpected expenses and to save for special events, such as, going to college. You can create a weekly, monthly or yearly budget.

So, what is a budget and why do we need to do it?

Budgeting is a way of ensuring we are living within our means. There are many reasons why we need to budget which benefits you and your money:

- Helps to understand your money in and out

- Ensures you are in control and not over spending

- It is smart in order to plan your future moneywise

- Lifelong skill

- Helps you to make the most of your money

Let’s take a look at how budgeting works in the real life…

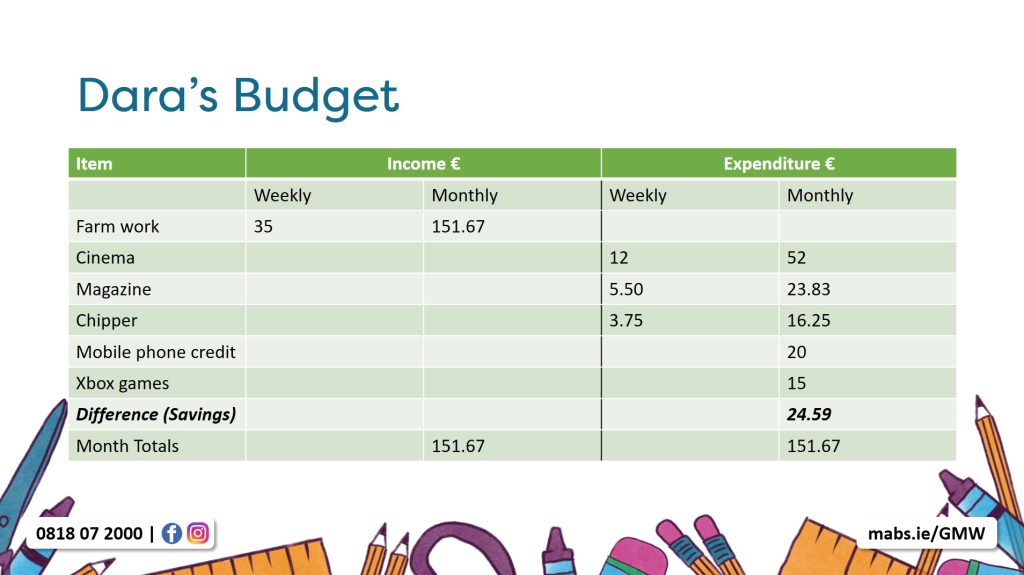

Budgeting Case Study, meet Dara!

How do we prepare a budget for teenage Dara, based on the below information?

- Earns €35 per week working on the Family Farm

- He currently has €50 saved in his savings jar

- Each week Dara spends €12 on the cinema, €5.50 on magazines and €3.75 on chipper

- His monthly spending is €20 on phone credit and €15 on Xbox games

- He wants to buy a €100 ticket to a local film festival, as well as a birthday present for his mother

Dara is 16 and lives about 3 kilometers outside a small town in the midlands. He is in Transition Year in the local school, and travels to and from school each day by bus. His Mam pays for the ticket.

Dara helps his parents on their busy farm. They pay him €35 per week and he does not have another part-time job. His parents are always helpful when Dara needs money for school or for clothes. If he wants to go out with his friends, buy games or phone credit, he has to pay for this himself.

Dara’s Mam has always encouraged him to save, so each week he tries to put whatever he has left in his pocket into a jar in his room. The jar is filling up but Dara is not sure where the best place to save would be. He has about €50 saved in the jar.

Dara is busy at home but he loves the cinema and goes most weekends – his Dad drops him into town and the night out usually costs him about €12. He gets a weekly film magazine on order from the local newsagent that costs him €5.50 per week. Although most of Dara’s friends like to hang out at the chipper every lunchtime, Dara goes with them just once in the week. Lunch from the chipper costs €3.75, and his Mam makes him a decent lunch anyway. Dara spends about €20 a month on phone credit. Each month, he spends €15 on Xbox games.

In two months’ time, there will be a film festival in the city and he would like to buy a festival ticket so he can go see as many films as he wants. This ticket will cost €100. He doesn’t know if he can save up as much as that because he spends most of his money every week and he wants to buy a nice birthday present for his Mam who is turning 50.

Ask yourself…

- Will Dara be able to save for the ticket from money he will earn in the next two months, or will he have to use the €50 in his savings jar?

- Do up a budget showing how Dara can cut down on his spending. Do you think he will be able to stick to this budget?

- What would you suggest to make things easier for him? Do you think Dara’s savings jar is a good idea? Would you suggest a better option for Dara to save his money?

Dara’s Budget

A budget helps you to plan your spending and manage your money more effectively. Through budgeting, we can make sure there is a balance between income and expenditure.

In the case study of Dara, certain changes and sacrifices need to be made in the budget for Dara to achieve his needs and wants.

Want to learn more?

Keep reading to learn about what the difference is between a need and a want and how to identify them. Or, maybe you’d prefer to get to the MABS Global Money Week homepage.

You can also visit the Global Money Week Official Website for more information.

Facebook

twitter

Instagram