Borrowing or getting a loan is neither ‘good’ nor ‘bad’, but taking out a loan is a big decision. You must be over 18 to get a loan. It is also important to ask if borrowing is the best option?

Let’s look at some reasons why people borrow…

- Needs and Wants

- Life

- Expensive

1. Needs and Wants

We borrow because we need to purchase something or we want something now.

Ask yourself, do you really need it? Can you save for the item?

2. Life

We borrow at different life stages, such as:

- Going to College

- First Car

- Holiday

- Wedding

- Mortgage or,

- For emergencies, if we do not have enough savings.

3. Expensive

We borrow if the item, for example a car, is too expensive to save for. Everyone else has it, why not me?

Ask yourself, what happens if I cannot pay back the loan?

Let’s take a look at a borrowing example…

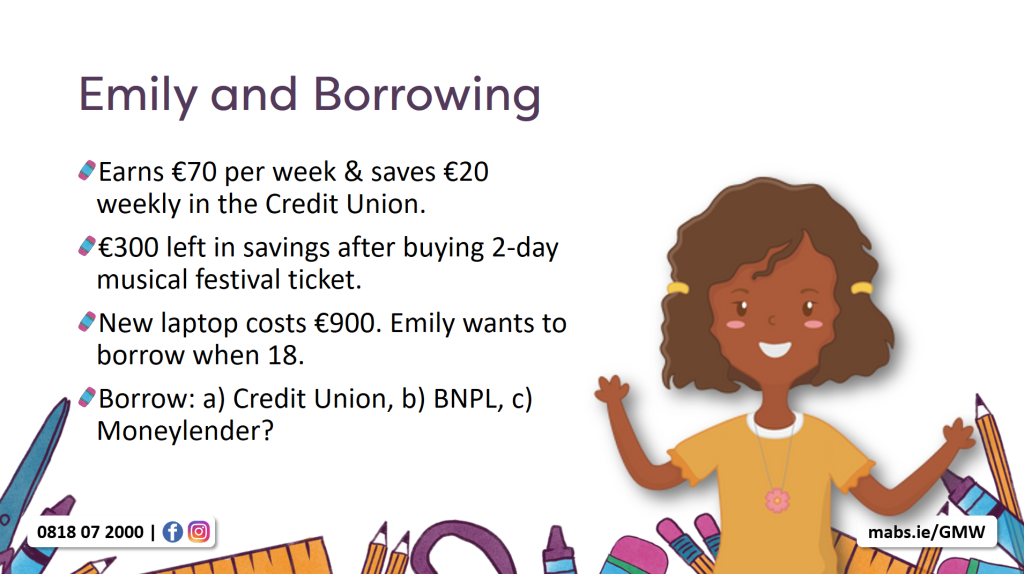

Borrowing case study, meet Emily!

Emily is going to be 18 this April and is in 6th Year in secondary school.

Emily has a part time job working in a florist every Saturday, earning €70. She spends most of her money every week, but always manages to save €20 from every payslip and puts this into her credit union savings account.

Emily recently dipped into her savings to buy a 2-day music festival ticket that takes place this summer. She now has €300 left in her savings.

Emily is looking to buy a new laptop. Emily’s wants to buy a good lap top for her photography hobby. She has her eye on one that costs €900.

Emily is considering borrowing the money for the laptop when she turns 18 in April. Her options are:

- Borrow from the credit union the full €900 leaving her €300 savings. The loan officer in the credit union told Emily that her mum or dad would need to guarantee the loan.

- Emily noticed in the computer store that they do ‘Buy Now Pay Later’. The store assistant explained to her that she could pay €300 when purchasing the laptop; pay €300 in 30 days and the final €300 in 60 days. Emily has to be 18 to be eligible.

- Emily has an older cousin and he often borrows money from a moneylender. He tells Emily that the interest rate is high, but the credit is easy to get with not too many questions asked. The first loan is usually for €500, and will be paid back over a year.

What questions should Emily ask before she borrows?

- What other options does Emily have? Emily could look at budgeting and save for the laptop, ask her parents or maybe get more hours in work.

- Does she really need the laptop right now? Emily could wait, save up the money or consider a cheaper option.

- Does Emily want a loan, repayment amounts or has she considered the total cost of credit?

- What happens if she is unable to pay back the money borrowed?

Want to learn more?

Keep reading to learn about budgeting. Or, maybe you’d prefer to get to the MABS Global Money Week homepage.

You can also visit the Global Money Week Official Website for more information.

Facebook

twitter

Instagram